Teach Your Kids Money Principles With a Board Game

With all the talk about raising financially responsible children, we are featuring this post from the archive.

For years I’ve been looking for a fun way to teach basic money concepts to my kids. Granted, there’s Monopoly, a board game classic. In our house, it had become the go-to game for my 8 year-old, but I’m not sure his attraction to it is a good thing. He aspires to become independently wealthy without too much effort, so I wince each time he successfully buys Boardwalk and says he can now kick back and retire. I keep hoping to teach him some basic financial planning skills before he discovers the reality that money rarely comes to people who sit around wishing they had more.

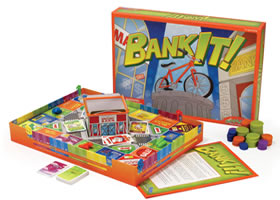

As I played Bank It by SimplyFun games with my kids, I breathed a sigh of relief. It is possible to strengthen their financial literacy while having fun and allowing them to learn from their mistakes in a safe way.

Bank It is unique because it has something for every kid. For my goal-oriented son, once he heard the main goal of the game was to save $10, he figured he would win. “All you have to do is not spend your money!” I remember feeling that same sense of confidence as a kid, before I learned that just being alive costs money. Whether it’s the unexpected or simply changing the temperature of the air inside, not all of our “spending” decisions are presented to us as choices. Saving money requires more than discipline and luck, it requires wisdom.

The board game spares us the monotony of paying for utilities, but it does present some unexpected scenarios like having to buy someone a birthday gift or accidentally breaking a window. The game rules also require each player purchase four items before they can win the game. The question is not will you buy something (because living costs money, after all) the real question is will you buy this now or wait for an item with a better price later.

In addition, you can’t win the game until you make a donation to charity. It’s a powerful reminder that giving should be as much a part of our budget as our everyday needs.

My daughter, who is 5, is starting to relate to mathematics by playing Bank It. One time she had to pay for something and she didn’t have the right change, so I gave it to her by taking a $1 coin and explaining it was equal in value to the four quarters I gave her. Ever since then, she keeps asking to make that same exchange. It’s possible she doesn’t “get it” yet, and just thinks four coins look like “more” than a dollar coin. But one day when she needs to make change at a store, she’ll know what she needs to make a dollar from quarters. This is the kind of lesson that makes math tangible, removing it from some high abstract shelf and placing it somewhere within our reach.

My daughter, who is 5, is starting to relate to mathematics by playing Bank It. One time she had to pay for something and she didn’t have the right change, so I gave it to her by taking a $1 coin and explaining it was equal in value to the four quarters I gave her. Ever since then, she keeps asking to make that same exchange. It’s possible she doesn’t “get it” yet, and just thinks four coins look like “more” than a dollar coin. But one day when she needs to make change at a store, she’ll know what she needs to make a dollar from quarters. This is the kind of lesson that makes math tangible, removing it from some high abstract shelf and placing it somewhere within our reach.

Even though my daughter can’t understand the arithmetic required when she has to pay for an item that adds up to $1.80 (as an example), the game cards contain an illustration of the necessary coins: a $1 coin, two quarters, and three dimes. So again, even a young player can begin to grasp addition, in fact my daughter has discovered she can play as the game’s banker just by looking at what change is required for each transaction.

With each turn, the game gives players the opportunity to earn money, spend it, or save it. Since the savings threshold to win the game is just $10, a child will also learn that there is more to life than making money. You could have $20 in the bank, but if you haven’t purchased necessary items and given to charity, you will lose to the person who banked only $10.

Bank It also illustrates the power of savings and interest. For players who catch on quickly, they will soon learn a savings account has the potential to make as much money as doing your chores. It may not seem applicable these days since the interest earned in savings accounts is paltry, but it’s a lesson that will serve a child well. For example, saving money in an emergency fund will save you from paying credit card interest (currently averaging 18%) since you can afford to pay for the unexpected with cash instead of going into debt.

If I had to make one nit-picky change in the game, I would change the price on the babysitting card. Even my 8-year old thought the wages earned for babysitting were meager, especially when compared to the wages earned for walking someone’s dog. As a result, my son concluded he’s never going to babysit. Of course, that is his choice, but I’m not sure I like the reason for his conclusion. As is true of anything we do with our kids, sometimes the value of that time depends on the interaction we have with them. In our case, the babysitting card sparked a conversation about how parenting is much harder than pet-sitting, but it can also provide significant rewards.

In my opinion, Bank It is a terrific way for elementary-aged kids to learn the basics of handling money. But I would also like to hear from you:

If you know of a game that is similarly educational without sacrificing fun, let me know in the comments below. And by all means, if you have an idea for an entertaining way to teach kids the importance of buying what you need as opposed to spending all that you have, please let me know. That’s the next lesson I hope to teach my kids, and I know a few adults who might benefit from such a game, too!

Bank It is only sold through consultants or “Playologists” of SimplyFun games. My kids received the game from their aunt and uncle who are consultants, here is their site. If you would like to learn more about the benefits of the game, click here to watch a video.

No Comments