Financial Facts to Consider During Black History Month

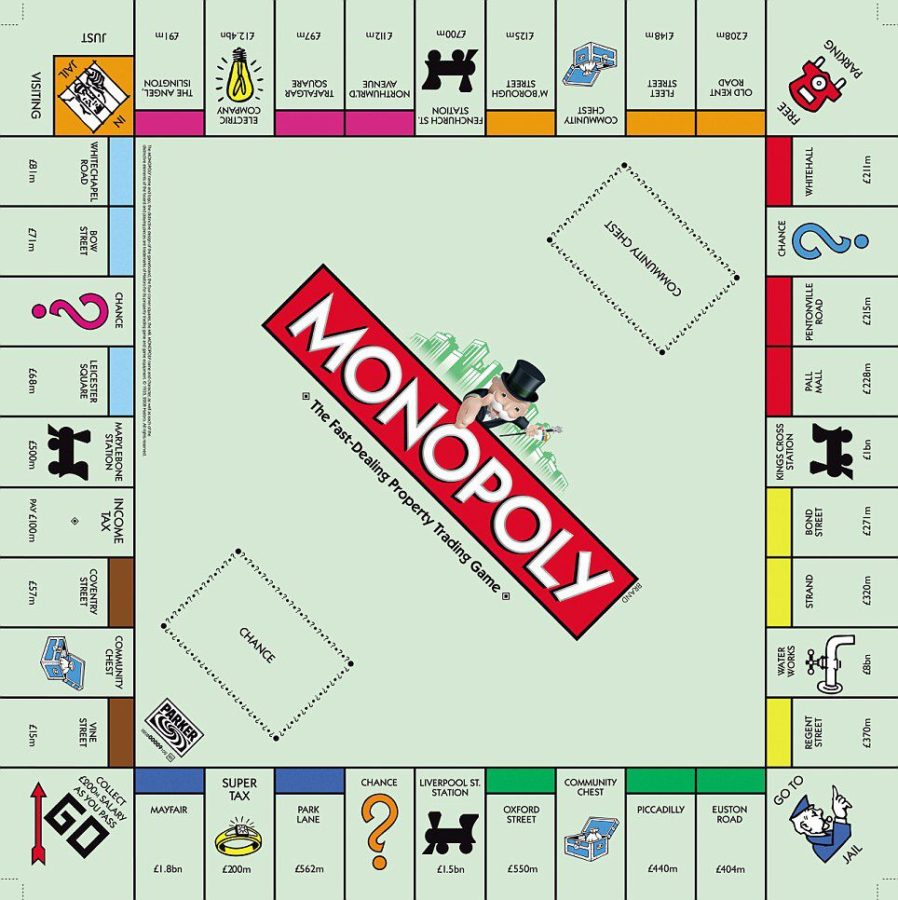

Along with United States’ general history, there are some aspects of our financial past that deserve consideration during African American History Month. Despite the fact that the American Dream may seem reachable for all these days, our “land of opportunity” moniker has not applied to all citizens. In the Monopoly game of life, some of us received a 200-year head start.

Elena Aronson, Director of Learning Communities for Arrabon.com, explains this phenomenon using one of America’s favorite board games. Let’s say your family is playing Monopoly, and you break the room up into men vs women. The men will start the game now, and the women will join the game an hour later. The women get the same starter income as the men, but they find themselves trying to compete on a board where most of the properties are already owned by players who have been building up their bank accounts for the past hour. The women are doomed to remain tenants, even if the occasional woman can catch up to the men due to a combination of great luck and skill.

It wasn’t until the Fair Housing Act of 1968 that African Americans were given the same home ownership rights as the rest of the players on the board. In a 2019 Survey of Consumer Finances from the Federal Reserve, the median homeowner has 40 times the household wealth of a renter with $254,900 vs $6,270.

Let’s take a look at the definition of the American Dream according to Investopedia:

“The American dream is the belief that anyone, regardless of where they were born or what class they were born into, can attain their own version of success in a society in which upward mobility is possible for everyone. The American dream is believed to be achieved through sacrifice, risk-taking, and hard work, rather than by chance.”

Can we still claim upward mobility is possible for everyone when some players were forced to arrive late to the game? This Monopoly analogy describes only a fraction of the hardship thrust upon African Americans, but from an economic standpoint, it fits. The exponential effect of multiple generations of homeownership has resulted in a situation where even though the starting size of bank accounts was the same, the results over 200 years have been anything but fair.