Top Ten “Sweet Spot” Applications for Your Money

Dr. Christine Carter has studied well-being and elite performance for more than a decade.With a Ph.D. in Sociology, she coaches people all over the world on these topics. Surprisingly, as she wrote in her book, The Sweet Spot, she needed more:

“To be totally honest, in my day-to-day life, I used to struggle to walk the talk. Five years ago I was a single mother holding down three demanding part-time jobs, and my life was a blur… In some ways, I practiced what I preached. But in other ways, I was caught up in the busyness of modern life – winded, running on a hamster wheel, afraid to slow down. I’d lost my groove.”

In other words, wellness is about more than knowing. You also need to feel it, plan for it, guard it. This is why I had no financial wellness despite becoming a Certified Financial Planner™. I had all the knowledge but not enough of the “feels.”

Money is a big part of wellbeing because our relationship to it colors many other aspects of our lives: contentment, dreams, relationships, confidence, even love. If you are trying in increase your wellness, you’re missing out if you refuse to tackle your financial life the same way you have conquered your emotional, physical, and spiritual wellbeing. It’s time to address your relationship with money. And if you find it’s out of balance, take courage: you are not alone, in fact you are in good company. Dr. Carter has been there, I’ve been there, and I am willing to bet many of your friends are in our club too (although they may not admit it until you have an intentional conversation with them.)

As our community of women creates more financial wellness in our lives, here are the Top Ten applications for your money life from Carter’s book, “The Sweet Spot – How to Find Your Groove at Home and Work.”

- Take recess – This one was such a huge takeaway for me, I wrote an entire post about it.

- Be the tortoise, not the hare – Consistency deserves its own post as well.

- Reward yourself – The right reward system is key to lasting transformation: see post

- Find balance – more posts: click here to learn about balance as an alternative to hospitalization, or click here to read about the balance of engaging in your finances vs. letting go.

- Switch on autopilot – This idea has several key points:

- Why – Carter advocates reducing the number of decisions you have to make on any given day so you can better redirect your energies toward productive activity. In other words, “When we use our brain’s natural ability to run on autopilot, we let our unconscious brain do work that we’d otherwise get done through the sheer force of our ironclad will (or not get done, due to lack of self-discipline and focus.)”

- What – Create a habit. Carter emphasizes the usefulness of converting responsibilities (paying bills, disputing charges, creating a spending plan) into habits thereby reducing the amount of effort is required in deciding to do the task. This is one reason I make my “Five a Week for Financial Wellness (FWFW)” challenge available, so you can get your money work done with ten minutes a day on weekdays.

- How – To apply this idea to your finances, it’s important to utilize some systems to reduce the number of decisions and energies directed toward your finances. My favorite systems are autopay for your bills, First Step Cash Management for your Spending Plan (all my coaching clients get a complimentary plan with online access) and setting up bank accounts with sub accounts and automated transfers to build up savings.

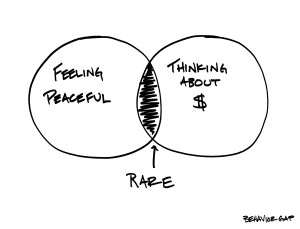

Another gem from Carl Richards of www.BehaviorGap.com

- Stop Stressing – Since money is a topic that incites a stress response in many of us, it’s worth evaluating our overall stress levels and discovering a way to reduce them. Carter’s advice is, simply put, there’s just no need for us to be so busy. I know it’s sounds completely crazy to think of saying “no” enough to reduce the size of your to do list. I never understood the concept until I was literally sick in bed for two years. But the evidence is compelling, especially when you are trying to make changes in your life, “If we are trying to learn something while stressed–out, we’re in … trouble. While we will almost certainly learn to be afraid of future situations that are similar to the ones we are in now, for the time being our short-term memory is shot. So don’t count on being able to remember that new term or method that we heard earlier.” Carter challenges readers to take on a new mindset around busyness: “Busyness is not a marker of intelligence, importance, or success. Taken to an extreme, it is more likely a marker of conformity or powerlessness or fear.” How does that sit with you? At first it seems like a harsh statement, but when I’m honest with myself, my busyness has definitely been motivated by a desire to fit in. This revelation motivates me to say “no” more often, and instead:

- Create Physiologies of Ease – Carter explains,”When we’ve experienced stress, positive emotions return us to our natural state, undoing the damage that stress does, putting us back at ease.” It’s important we recognize the need to counteract it in positive ways with “physiologies of ease” or positive emotions:

- Crack a grin. As Carter suggests, make it “a real eye-crinkler scientists call Duchennes smile.” While you’re at it, try laughing. It augments the positive physiological effects of smiling. During this TED Talk, at the 12:00 minute mark, cognitive neuroscientist Sophie Scott talks about the effect of laughter on stress.

- Strike a power pose to lower your cortisol (commonly known as the stress hormone.)

- Meditation or any exercise that promotes mindfulness. For example, they say breathing is like a remote control for our bodies, so if you need a place to start, try this visual.

- Go enjoy nature, it promotes wellbeing.

- Work on positive emotions such as gratitude, awe, compassion and love; these are also known to decrease heart rate. From a financial perspective, where might you find stories that will inspire all these feelings? Try our discussion group on Facebook: Women’s Wellness Through Money Conversations

- Get Inspired by Your Future Plan – this concept works best in two steps:

- Imagine – Maybe it has been a while since you’ve tapped into your imagination, but Carter describes the benefit of this exercise. “Research has repeatedly shown that writing about our ‘best possible future self’ makes us happier and more optimistic. Here’s how to do it. Write for 20 minutes about your hopes and your dreams for yourself in the next 5 or 10 years. Where will you be living? Which friends and family will be in your life? How will you be spending your time?” Imagine what this could do in your money life, to articulate your dreams and even own them by putting them down on paper! As you explore your best possible financial future, take a moment to think of what it would take for you to flourish in life. Carter cites a study finding only 17% of the population are considered to be flourishing. considers themselves to be flourishing. Be careful of the tendency to blame money for our lack of flourishing, as money is often a scapegoat for issues we don’t want to recognize.

- Create a Plan – I will be the first to tell you to grip this plan loosely, very few people end up living the plan they laid out for themselves. But Carter points out that having a plan has caused research subjects to perform 74% better than those who don’t have a plan for specific task. So I recommend starting by creating short- and mid-term financial goals: establishing an adequate emergency fund, or building a savings account, or meeting the minimum for an investment portfolio. Remember, the most effective way to increase your success is to reduce the level of willpower necessary while also lightening the load of financial decisions you make. For example, pre-deciding how you will handle money means you won’t have to ask yourself, “Should I spend money on this fill-in-the-blank, or should I put it toward my savings to reach my goal for the year?” This step includes anticipating possible obstacles and figuring out ahead of time how you might overcome them.

- Build Gratitude – Of all the money skills you need to accomplish your goals, this one will take you farther than the others. Gratitude is not just an act, it’s a skill, Carter says, that “needs to be practiced consciously and deliberately.” So if being grateful is hard for you, perhaps you just need more practice? One could say the same thing about push-ups, right? It’s all about exercising the right muscles. Interestingly, gratitude isn’t just an exercise for those who have a lot. In fact, gratitude arises most naturally in conditions of scarcity. So there’s no excuse, everyone can learn to become more grateful. As you take inventory of the immense non-monetary resources you have at your disposal, consider helping someone else to further build your gratitude. Carter cites one study that showed people who were feeling worried and stressed about their finances felt better when they offered social support to others, so investing socially in others brings significant returns.

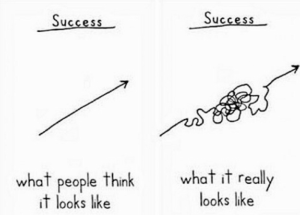

- Expect Setbacks –

Illustration by Demetri Martin in This is a Book

If only the path from failure to success was a straight line … Carter warns about the “Licensing Effect, when we behave virtuously and then “cancel out” good deed by doing something naughty.” Have you ever been on a diet and, after realizing some success, you then felt like you deserved a little cheat treat? The same tendency will rear its ugly little head as you strive toward financial goals. Carter points out one way to avoid the licensing effect, “by reflecting on your goals and values rather than your accomplishment.” In other words, recognize the life change you are manifesting as you work to achieve that savings goal. Ponder how it is helping you focus on what you have, not what you don’t. I would even take this advice one step further and suggest, even though you don’t want too many setbacks to derail you, be prepared to accept them as part of the process and move on. This is a key tenet of my financial coaching with clients, you need to learn how to forgive yourself, because shaming yourself only perpetuates the problem.